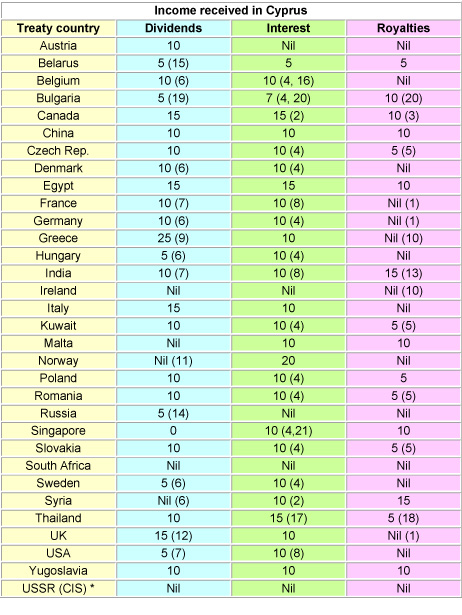

Tax treaties

Cyprus Tax Table

*Armenia, Kurghystan, Moldova, Tajikistan, Turkmenistan and Ukraine apply the USSR/Cyprus Treaty

- 5% on film and TV royalties

- Nil if paid to a government or for export guarantee

- Nil on literary, dramatic, musical or artistic work

- Nil if paid to the government of the other state

- This rate applies for patents, trademarks, designs or models, plans, secret formulas or processes, or any industrial, commercial or scientific equipment, or for information concerning industrial, commercial or scientific experience

- 15% if received by a company controlling less than 25% of the voting power

- 15% if received by a company controlling less than 10% of the voting power

- Nil if paid to government, bank or financial institution

- The treaty provides for withholding taxes on dividends but Greece does not impose any withholding tax in accordance with its own legislation

- 5% on film royalties

- 5% if received by a company controlling less than 50% of the voting power

- This rate applies to individual shareholders regardless of their percentage shareholding. Companies controlling less than 10% of the voting shares are also entitled to this rate

- 10% for payments of a technical, managerial or consulting nature

- 10% if dividend paid by a company in which the beneficial owner has invested less than US$100.000

- If investment is less than 200.000 euro, dividends are subject to 15% withholding tax which is reduced to 10% if the recipient company controls 25% or more of the paying company

- No withholding tax for interest on deposits with banking institutions

- 10% on interest received by a financial institution or when it relates to sale on credit of any industrial, commercial or scientific equipment or of merchandise

- This rate applies for any copyright of literary, dramatic, musical, artistic or scientific work. A 10% rate applies for industrial, commercial, or scientific equipment. A 15% rate applies for patents, trademarks, designs or models, plans, secret formulae or processes

- This rate applies to companies holding directly at least 25% of the share capital of the company paying the dividend. In all other cases the withholding tax is 10%

- This rate does not apply if the payment is made to a Cyprus International Business entity by a resident of Bulgaria owning directly or indirectly at least 25% of the share capital of the Cyprus entity

- 7% if paid to a bank or financial institution